Understanding Business Entity Concept in Accounting: Definition, Examples, and Importance

Although the definition might seem a little complicated at first reading, this is essentially a simple idea. Thus, the initial sale and purchase transaction is recorded on 25 January. Nowadays, the types of business entities mentioned above are widely used, but only every type fits certain types of businesses, so it is important to make the right choice for a business to achieve success.

Business Entity Principle

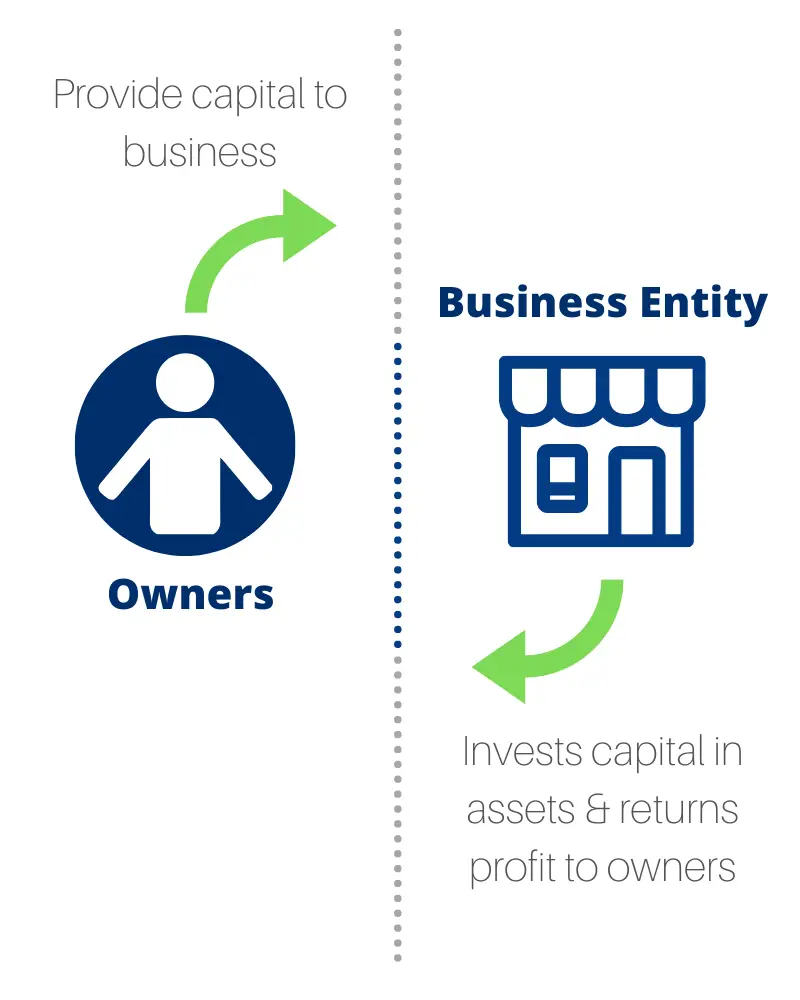

Like a sole proprietorship, a partnership can be formed without paperwork. The business entity definition is an organization founded by one or more natural persons to facilitate specific business activities or to allow its owners to engage in a trade. It needs resources to be able to operate and those resources have to be financed. Right from the start it often also needs to incur debts or liabilities to buy assets such as equipment and inventory that it will use for future financial benefit. Assets, capital and liabilities are the elements of the accounting equation, which expresses the relation between these elements. Apart from the owners, the business entity concept applies to subsidiaries of the same group as well.

What is a separate legal entity?

It entails creation of separate books of accounts for each entity in which owners are an external party just like a creditor, employee, etc. With a corporation, shareholders enjoy limited liability while the employees enjoy free tax benefits initiatives paid by the profits generated by the corporation. There is flexibility in antique silver bracket wallet with beaded bag and antique the transfer of ownership among corporations as it runs on a perpetual life system. Also, separating personal and business accounting tasks can be an overwhelming task for many business owners as it requires special accounting skills. Separate accounting records mean easier taxation compliance by the business and its owners.

How confident are you in your long term financial plan?

Types of business entities are divided according to the laws in certain states, and each state has its own types, so it is crucial for entrepreneurs not to make mistakes at the early stages. This means that there is no separation between the assets of a sole proprietor and their personal assets. In a sole proprietorship, the owner of the company takes all the risks and enjoys full benefits from the operation.

In all forms business, the personal transactions of the owners are not mixed up with the transactions and accounts of the business. This is because doing so would make an effective analysis of an entity’s financial performance and position impossible. Without this concept, accountants will find it difficult to properly separate business expenses from business owners to get accurate bookkeeping records. New businesses should opt for types of business entities that have a low cost and give the opportunity to manage it easily. It is also important to consider types of business entities that provide limited liability in order not to become fully responsible for debts incurred by your company. This means that types of business entities include C-corporation, S-corporation, and limited liability companies.

Get in Touch With a Financial Advisor

Business entities exist in different types and forms depending on specific characteristics that distinguish them from one another. A company owner rents a building complex of 2 standard halls for $10,000 per month. The owner then decides to use one of the halls for strictly business use and the other hall for his personal use.

Business owners can apply the business entity concept to any type of business to make accounting much easier. In conclusion, the business entity concept is a fundamental principle in accounting that treats a business as a separate entity from its owners. Understanding and applying the business entity concept is essential for maintaining transparent and reliable financial records, thereby supporting informed decision-making by stakeholders in the business. The business entity concept guides the preparation of financial statements by requiring that the business’s financial activities be recorded and reported separately from any personal transactions of the business owners.

- You can choose whether it’s treated as a corporation or as a pass-through entity for tax purposes.

- With a corporation, shareholders enjoy limited liability while the employees enjoy free tax benefits initiatives paid by the profits generated by the corporation.

- There is only one owner who is unlimitedly liable for all the company’s actions.

Thus, a corporation entity type fulfills the entity concept requirements by default. The concept of the business as a legal entity that is distinct from its owners has been largely accepted in the contemporary business landscape, but only for corporations. This straightforward example allows a key point about double entry to be made. While both parties will record the transaction, that is not what is meant by double entry.

Auditors would face a daunting task if these records were commingled. If you need help setting up your business entity, you can post your legal need on UpCounsel’s marketplace. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. Generally, a partnership can be either a general partnership, limited or a limited liability partnership, with the general partnership being the most popular and widely used of the two. Apart from competitors, you can compare companies to other business entities to determine their respective performance levels. Using the business capital for personal expenditure is considered a personal expense and increases the owner’s liability.