What Is Depreciation? and How Do You Calculate It? Bench Accounting

Our mission is to equip business owners with the knowledge and confidence to make informed decisions. Assets that don’t lose their value, such as land, do not get depreciated. Alternatively, you wouldn’t depreciate inexpensive items that are only useful in the short term. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

What Is Depreciation: Definition, Types, and Calculation

- To illustrate an Accumulated Depreciation account, assume that a retailer purchased a delivery truck for $70,000 and it was recorded with a debit of $70,000 in the asset account Truck.

- The group depreciation method is used for depreciating multiple-asset accounts using a similar depreciation method.

- The accumulated Depreciation account will show a debit balance as a result.

- The difference between the debit balance in the asset account Truck and credit balance in Accumulated Depreciation – Truck is known as the truck’s book value or carrying value.

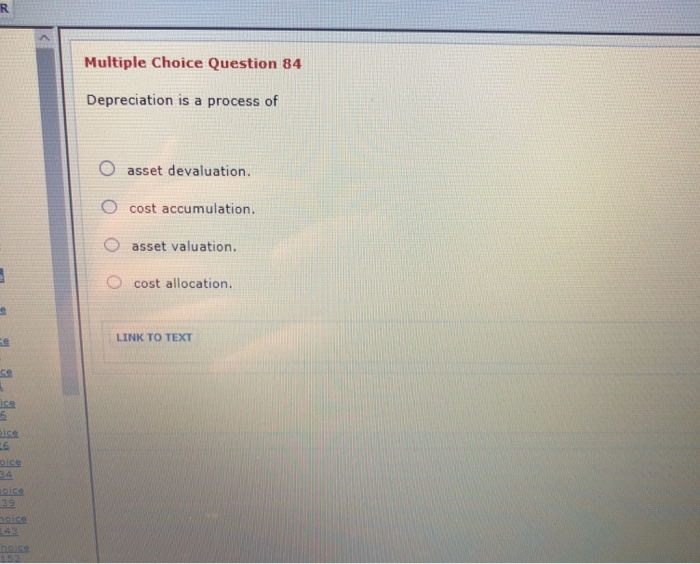

- The expense recognition principle that requires that the cost of the asset be allocated over the asset’s useful life is the process of depreciation.

Depreciation occurs when a non-current asset loses value due to use or passage of time. Depreciation does not result from any systematic approach but occurs naturally through the passage of time. Managing depreciation costs effectively using leading accounting software is your gateway to accurate, timely, and compliant reporting, best-in-industry accounting practices, and optimum business management. review of the independence and effectiveness of the operations evaluation department Applying this to Liam’s silk-screening business, we learn that he purchased his silk-screening machine for $5,000 by paying $1,000 cash and the remainder in a note payable over five years. Thus, depreciation is recorded for all tangible assets other than land, no matter how well maintained. The machine has a salvage value of $3,000, a depreciable base of $27,000, and a five-year useful life.

Ask Any Financial Question

It is the depreciable cost that is systematically allocated to expense during the asset’s useful life. The balance in the Equipment account will be reported on the company’s balance sheet under the asset heading property, plant and equipment. The assets to be depreciated are initially recorded in the accounting records at their cost.

What assets can be depreciated?

It’s an accounting technique that enables businesses to recover the cost of fixed assets by deducting them from their profits. While these two depreciation methods serve a similar purpose, they aren’t the same. For example, a business can’t claim Section 179 unless it has a taxable profit, whereas bonus depreciation isn’t limited by the company’s taxable income. Bonus depreciation can be a valuable tax break for businesses that purchase equipment, furniture, and other fixed assets. Depreciation in accounting and bookkeeping is the process of allocating the cost of a fixed asset over the useful life of the asset. The cost of the asset should be deducted over the same period that the asset is used to generate income instead of deducting a large expense when it’s purchased.

This allows us to see both the truck’s original cost and the amount that has been depreciated since the time that the truck was put into service. As a result, some small businesses use one method for their books and another for taxes, while others choose to keep things simple by using the tax method of depreciation for their books. If an asset is depreciated for financial reporting purposes, it’s considered a non-cash charge because it doesn’t represent an actual cash outflow. While the entire cash outlay might be paid initially—at the time an asset is purchased—the expense is recorded incrementally (to reflect that an asset provides a benefit to a company over an extended period of time). And, the depreciation charges still reduce a company’s earnings, which is helpful for tax purposes.

Under the composite method, no gain or loss is recognized on the sale of an asset. Theoretically, this makes sense because the gains and losses from assets sold before and after the composite life will average themselves out. The double-declining-balance method, or reducing balance method,[9] is used to calculate an asset’s accelerated rate of depreciation against its non-depreciated balance during earlier years of assets useful life. Depreciation ceases when either the salvage value or the end of the asset’s useful life is reached. Net fixed assets equals the cost of fixed assets minus accumulated depreciation. So, as accumulated depreciation increases over time, the value of net fixed assets decreases over time.

All assets have a useful life and every machine eventually reaches a time when it must be decommissioned, irrespective of how effective the organization’s maintenance policy is. When calculating depreciation, the estimated residual value is not depreciation because the business can expect to receive this amount from selling off the asset. Therefore, a reasonable assumption is that the loss in the value of a fixed asset in a period is the worth of the service provided by that asset over that period. Any way you choose to calculate the depreciation cost, you need to learn an essential formula to calculate your depreciables.

The expenditure incurred on the purchase of a fixed asset is known as a capital expense. Capital expenditure is a fixed asset that is charged off as depreciation over a period of years. The direct method calculates depreciable costs by subtracting the salvage value from the initial purchase price and any additional costs. Using Enerpize’s accounting software to manage your depreciation cost end-to-end keeps your depreciation costs in check and helps you grow at minimum asset loss or damage impact. Put differently, it is an asset’s initial acquisition cost minus its estimated salvage (remaining value) at the end of its usability or lifecycle. If you are a business owner, executive manager, or entrepreneur, you must understand what the depreciable cost is to account for business expenses correctly, timely, and compliantly.